Deal CFDs on more than 70 FX pairs and profit at reduced Spreads and quick Order Execution.

Trading CFDs on worldwide futures as well as exploring endless trading possibilities.

CFD trading on popular indexes across different countries worldwide.

Deal CFDs on thousands of leading global stocks and benefits for ultra-fast order execution with competitive market trading conditions.

Traders can trade CFDs on spot metals, which opens up new trading opportunities.

Trade Contracts for Difference (CFDs) on Spot Energy commodities, including Brent oil, WTI, and Natural Gas, to diversify your investment portfolio.

Discover new trading opportunities by trading CFDs on Spot Metals.

Take advantage of tight spreads and fast order execution when trading CFDs on Cryptocurrencies.

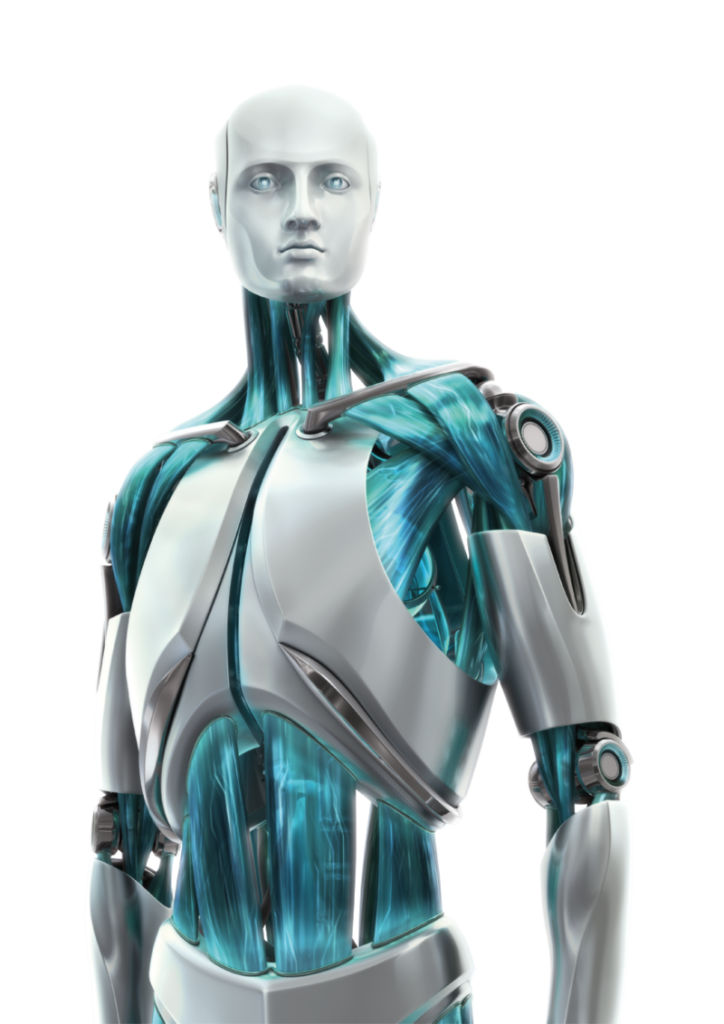

From 10 Years of innovation and excellence, we provide access to high-quality financial markets with our advanced execution model. Now we are proud to have the facilities of our new system AI Program, as well as the ability to execute.

Trading CFDs for spot metals and discovering new opportunities for trading

Trade on cryptocurrencies with one of the best platforms from tight spreads and fast order execution.

Trading CFDs on the most popular indices in Europe.

Traders can trade CFDs on thousands of global stocks and benefit from ultrafast order processing and highly competitive trading conditionality. Traded CFDs on shares of Some of the biggest & popular corporates in the US, UK & EU.

Trade CFDs on energy spots such as Brent oil, WTI, and natural gas and diversify your portfolio.

Trade CFDs on a range of instruments, including the Artificial Intelligence (AI) System, FX pairs, Futures, Indices, Metals, Energy, as well as preferred Stocks, while also experiencing worldwide markets for yourself.

AI2 Trade Since 2013 / The Queens Walk, London SE1 4AA, UK / License and Regulation by BE

84.60% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

AI2 Trade Ltd is authorized and regulated by the SCB (license no. RF_13AT04A).

AI2 Trade Ltd does not offer Contracts for Difference to residents of certain jurisdictions including the USA, Iran and Canada.